What You Need To Know About Depreciation in 2024

Make Depreciation Work for You: Key Insights for Equipment Owners

As a business owner, depreciation is an important factor in your accounting process and equipment purchasing decisions. The rules for calculating depreciation and taking an allowance on your tax return are set by the IRS. We always recommend going to your accountant or tax advisor for specific advice about how to approach depreciation for your business. Still, it’s good to have a basic understanding how depreciation works and how it may affect your business. Keep reading for an overview of what to know about depreciation in 2024.

What Is Equipment Depreciation?

Just as a vehicle loses its value over time, every piece of equipment decreases in value with use, normal wear and tear, and obsolescence. To put it another way, equipment depreciation is a metric that shows how much value a piece of equipment loses each year with regular use.

Depreciation helps businesses make purchasing decisions. It allows you to account for all the costs associated with owning a piece of equipment over its useful lifespan, including installation and ongoing maintenance, not just the initial purchase price.

Useful lifespan refers to the amount of time you can use it for its intended purpose. For example, a laptop computer will have a shorter useful life than a new truck because tech devices fall into obsolescence relatively quickly.

Overall, depreciation allows you to more accurately calculate your profit from a certain piece of equipment. It also helps you determine when it’s time to replace a piece of equipment nearing the end of its useful lifespan.

What Causes Equipment Depreciation?

Understand the primary factors in determining equipment depreciation.

Wear and Tear

Wear and tear is the normal damage that comes from regular and frequent usage of your equipment and machinery. For example, construction equipment can experience wear and tear such as lifts that need repair, worn tires and tracks, and more from the demanding tasks this type of equipment performs.

Obsolescence

As more and more equipment incorporates technology, obsolescence is becoming more common in equipment depreciation. For example, farm equipment now routinely utilizes technology such as GPS, drones, sensors, and telematics to increase efficiency.

However, technological advancements also lead more quickly to equipment obsolescence and make the older models less valuable and more costly to maintain. For example, it can be harder to find replacement parts as machinery depreciates and becomes obsolete. Parts you can find will be more expensive.

Useful Lifespan

Depending on the age and condition of the equipment when you purchase it, you can expect to get a certain number of years from its useful lifespan. To be eligible for depreciation under IRS rules, an item must have a useful life beyond one year. If you’re not sure of a piece of equipment’s useful lifespan, consult Appendix B of the IRS’s Publication 946.

How Do I Calculate Depreciation?

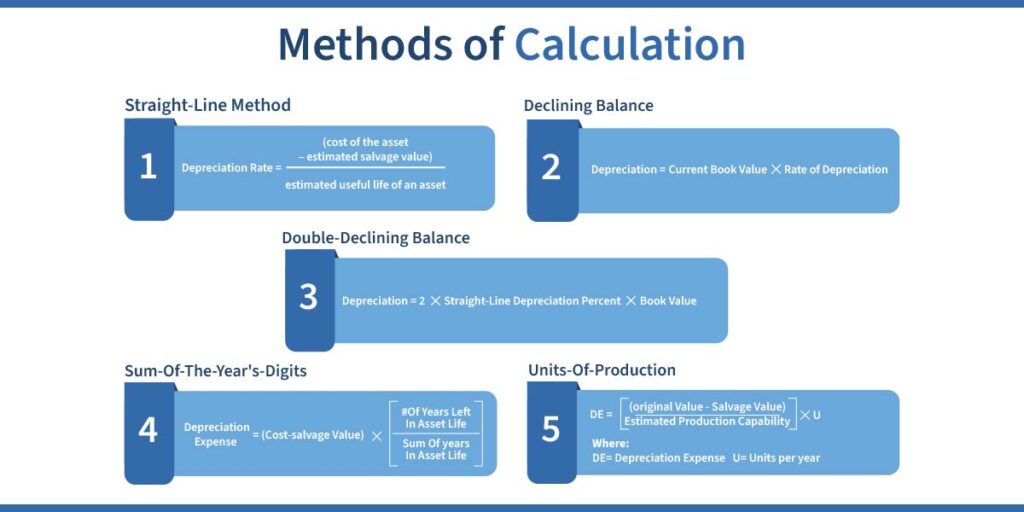

Calculating depreciation is usually the responsibility of your business accountant. Depreciation expense is reported on your federal income tax return. However, understanding the different ways to calculate depreciation can help you make informed equipment purchasing decisions.

The depreciation rate is the amount of the cost (purchase price) that can be deducted each year, usually presented as a percentage. It’s calculated based on the typical useful life of the machinery. For example, a forklift with a lifespan of five years (based on a typical lifespan of 10,000 hours) would have a depreciation rate of 20%.

Straight-Line depreciation is the most popular method of calculating depreciation. You’ll need to know the asset cost, which is what you paid for the machinery, as well as the salvage value, which is what you can sell the piece of equipment for once it reaches the end of its useful life.

The method you choose for calculating depreciation can depend on different factors, including the purpose of your financial statements, tax considerations, and overall management preferences. If you don’t calculate depreciation, your financial reports will not reflect the true value of your equipment and machinery. You may also be missing out on tax savings–consult your accountant for advice about your specific situation.

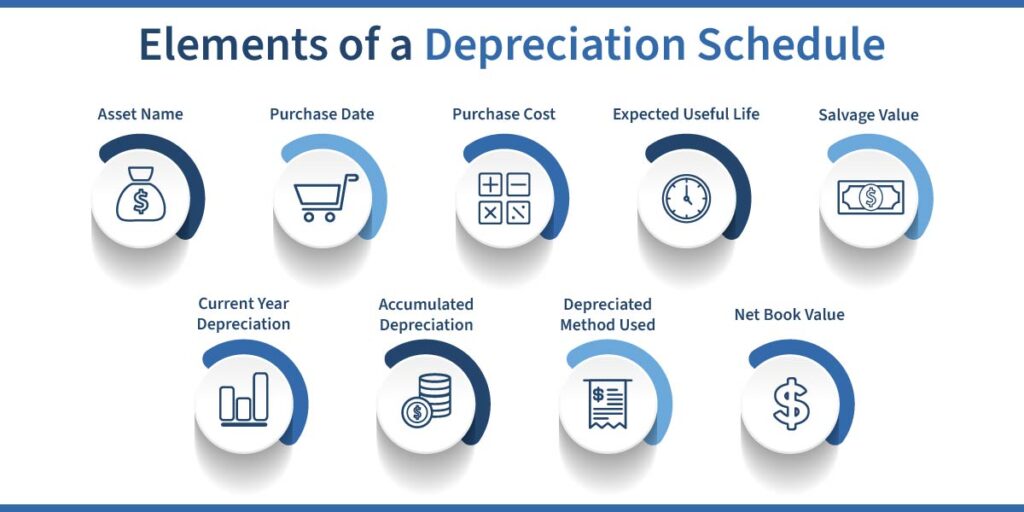

What is a Depreciation schedule?

A depreciation schedule is a chart showing a piece of equipment’s loss in value over its useful life, using your chosen accounting method. Having a depreciation schedule is necessary in your financial modeling to help you track deductions and stay on top of the big picture. Depreciation schedules help forecast the value of your fixed assets, depreciation expense, and capital expenditures. While most depreciation schedules are typical, the elements may vary depending on how much detail you want to provide, and the method you use to calculate depreciation.

What does depreciation mean for tax purposes?

Calculating depreciation can get complicated. There’s not a one-size-fits-all approach that will work for every business. Consult with your tax advisor or accountant about how to approach depreciation in your specific situation. In this section, we’ll provide an overview of the potential tax advantages of calculating depreciation. Publication 946 from the IRS offers a guide to depreciating property. This includes Section 179, a special depreciation allowance.

In addition to the standard approaches to calculating depreciation, you can elect to take a 100% special depreciation allowance for equipment acquired after September 27, 2017, and put into service before January 1, 2023. This applies to both new and used heavy equipment and machinery, both purchased or on a lease.

This special depreciation allowance can offer a major benefit and tax relief for small businesses. For 2024, the cap is $1,220,000 for the total amount written off and $3,050,000 for the total amount of the equipment purchased.

Most tangible goods qualify for the special depreciation allowance, including “off-the-shelf” software and business-use vehicles. Equipment, vehicles, and software must be used for business purposes more than 50% of the time to qualify.

About Blue Bridge Financial

Founded in 2009, Blue Bridge Financial is a specialty equipment finance firm providing small and medium-sized businesses with secured loans for revenue-producing, essential-use equipment. We serve a wide range of industries and can help you finance new or used equipment. Read more about Section 179’s special depreciation allowance on our website and contact us to learn more about your business equipment financing options!

Any Questions? We'd Love to Talk:

About the Author

Nick Devernis is the Vice President of Business Development with expertise in credit analysis and equipment financing. With over 6 years in equipment financing, he offers a wealth of knowledge to readers of Blue Bridge Financial’s blog. He currently oversees the California office and leads the Sales and Marketing departments. Nick’s role as Vice President of Business Development involves management of the sales team, relationship management, and developing strategic partnerships to drive inbound and outbound originations.p> LinkedIn Profile