Private Party Equipment — Pros and Cons

What to Consider Before Buying Equipment from a Private Seller

Before you invest in the necessary equipment for your business, exploring your options is always a good idea. Even for established companies, buying new isn’t always the most cost-effective solution. Pre-owned equipment can be just as reliable, at a fraction of the cost.

But if you’ve never had to look into used equipment financing, it can be difficult to know where to start. In this guide, we’ll walk you through what you need to know about financing private party equipment.

What is considered private party equipment?

Heavy equipment purchased from an individual, or an individual business, are considered private party equipment. There’s no vendor, dealer, or retailer involved in the transaction and you’ll work directly with the seller to complete all aspects of the equipment purchase.

When you’re looking for private party equipment, the best place to turn first is your own business network. Ask your contacts if they know anyone selling the equipment you’re looking for, or browse the ads in a trade publication. Online used equipment inventories are also a good place to look at, particularly those that specialize in private party equipment financing.

Pros of private party equipment

Costs

One of the biggest benefits of private party equipment is that it’ll usually cost you less than either buying new or working through a dealer or retailer. With private party, you’re going straight to the source and cutting out the middleman. That means lower fees during the sale and, often, a lower sticker price on the equipment.

Private party equipment is usually used, even if it shows little signs or wear and tear. That means it will have already gone through some depreciation on the brand new value, which will keep prices lower for you.

Flexibility

When deals happen between two private parties, there’s more room for flexibility and negotiation. This can be on anything from the terms of the sale to the purchase price. Having this flexibility can be helpful when you’re trying to save money and get a good deal, or have specific requirements like delivery windows that you’re trying to adhere to.

Cons of private party equipment

Trust

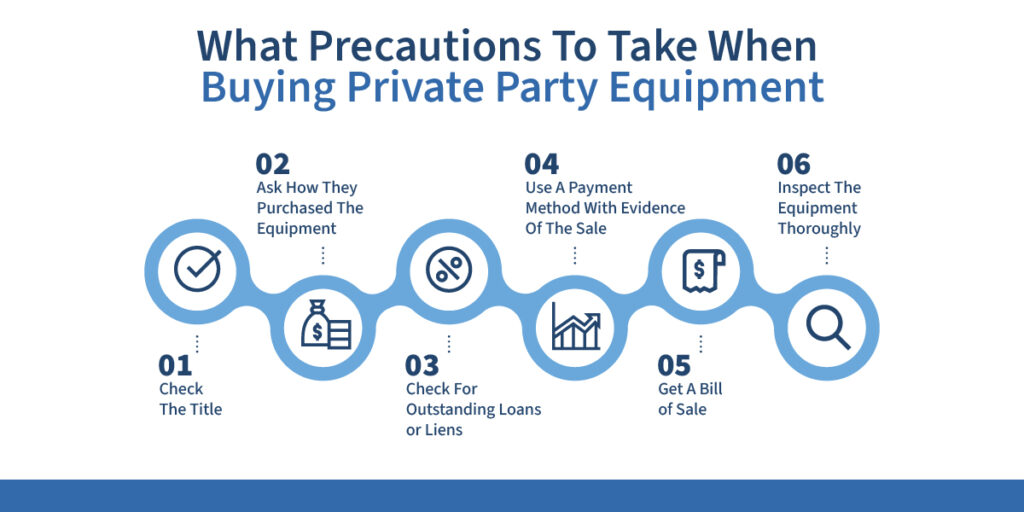

Working directly with the seller can come with significant benefits, but you also need to put your trust in them and their word. You have to believe that they’re being forthcoming and upfront about any past issues with the equipment, along with the history of how it’s been used and where it comes from. You also have to make sure they’re the legal owner before making the purchase!

Financing

Some lenders may have stricter requirements when it comes to private party equipment financing, since there are more risks involved when cutting out a dealer or retailer. This could also mean higher interest rates for you instead of a loan that you’d get for a traditional used equipment sale.

Many lenders will cap term lengths or have a set age limit on the equipment when buying privately. Blue Bridge Financial does not set these limits and instead offers flexible, tailored solutions for buying privately.

Warranties

When you buy from a private seller, the equipment may or may not come with any warranties. Some will transfer to the new owner with a small fee, but if the previous owner or seller didn’t keep up with maintenance, the warranty could now be void. Always ask the seller about any warranties in place and if they’re transferable upon purchase.

Liens

You’ll also need to make sure that there are no liens on the equipment that the previous owner has. Look for a clean Uniform Commercial Code (UCC) search before agreeing to the sale.

There should always be a clean paper trail back to the original purchase. If the owner no longer has some of this documentation, your UCC search is even more important as you’ll need to rely on good faith and trust that they’re being honest with you. Discovering a UCC or lien on the equipment late in the process will significantly delay your financing process, thus your purchase.

Alternatives to private party equipment

Purchasing with a dealer

If you’re looking for new equipment, buying through a dealer or vendor may be your best option. This equipment usually comes with the latest technology, along with manufacturer warranties still in place and the option for extended coverage.

You’ll have a wider selection to choose from in one location, but it may cost more than private party equipment. With private party equipment, you’ll need to do more research and take more time to find a specific piece of equipment. Some dealers offer certified pre-owned equipment to help stay within budget, similar to a pre-owned vehicle. This can be a good compromise if you’re looking for a more trusted option but still want to buy used.

Leasing

When you lease equipment, you’ll be paying a small monthly payment until the full purchase price has been made. You won’t actually own the equipment until the lease term has been completed and paid in full, but this can give you the ability to upgrade to better equipment sooner and in a more cost-effective way.

Rental

For short term projects, renting heavy equipment is often cheaper than buying something. You won’t be committing to ongoing maintenance when you rent your equipment and, in most cases, you won’t have to store it either. However, keep in mind the costs if you work on a number of similar projects, as you’ll be paying for a new rental every time.

Auctions

Going to an auction is a good middle ground between a dealership and private party sale. As an organized event, you’ll be able to view more inventory at one time and make a decision that works for you. There’s also incentive for sellers to negotiate on price at auctions, so you could walk away with a great deal.

Commonly purchased private party equipment

There are many industries that require heavy equipment to support their daily work. Many of these use private party equipment sales to buy the gear they need at a lower cost, including:

- Construction—excavators, bulldozers, loaders, and cranes all are commonly used in this field.

- Agriculture—everything from tractors to combine harvesters and balers can be bought through private parties.

- Transportation—semi-trucks, flatbed trailers, dumb trucks, and box trucks are always available on the private market.

- Landscaping—commercial mowers, tractors, and skid-steer loaders are all needed for even small-scale landscaping businesses.

- Logging and Forestry—feller bunchers, skidders, and loaders can all be bought through private sellers.

- Manufacturing and Industrial—presses, forklifts, and CNC machines are often cheaper when purchased privately.

Equipment financing that’s right for your business

Blue Bridge Financial offers private party equipment financing that’s tailored to the unique needs of our clients. As a result, we can often say “yes” faster than other lenders, helping you get your needed equipment as quickly as possible. Contact us today to discuss how you can finance used equipment purchases, or browse our inventory to get started.

Any Questions? We'd Love to Talk:

About the Author

Nick Devernis is the Vice President of Business Development with expertise in credit analysis and equipment financing. With over 6 years in equipment financing, he offers a wealth of knowledge to readers of Blue Bridge Financial’s blog. He currently oversees the California office and leads the Sales and Marketing departments. Nick’s role as Vice President of Business Development involves management of the sales team, relationship management, and developing strategic partnerships to drive inbound and outbound originations.p> LinkedIn Profile