Common Financing Roadblocks: How To Prepare For And Overcome These 5 Obstacles

Don’t Let Financing Hurdles Stall Your Growth: What to Watch Out For

Knowing what to expect and how to best prepare for your equipment financing application can help you get approved. In this article, we cover the 5 most common challenges we see during the application and funding process and how you can overcome them. If you have any questions, we’re here to help.

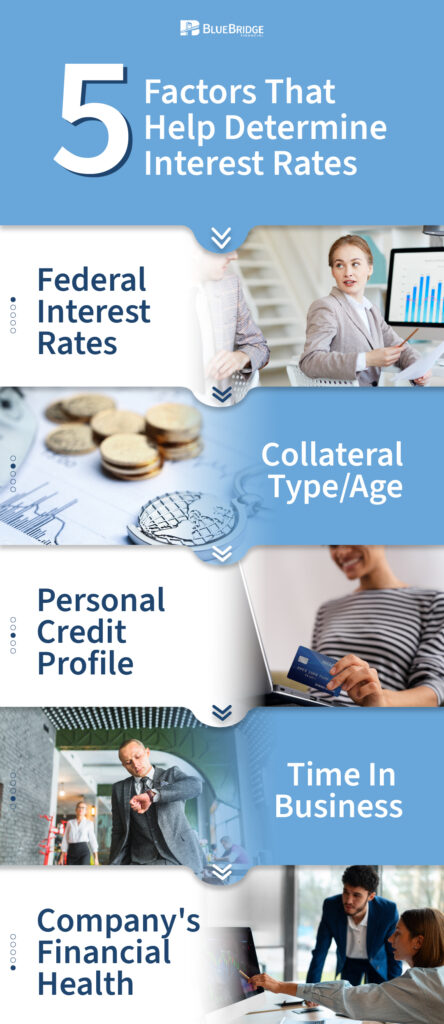

Interest Rates

In a high interest rate environment, businesses may hold off on purchasing new equipment or shop around for months, waiting for rates to drop. While everyone wants a low interest rate, it’s better to focus on the necessity and ROI of the equipment. If your potential revenue from purchasing new or upgraded equipment outweighs your monthly payment, it’s a profitable decision regardless of the interest rate.

Also, the potential cost to your business of not acquiring the piece of equipment could put you in a worse position. What jobs and revenue would you miss out on? What work would you not be able to complete efficiently without this new equipment?

Ultimately, there isn’t a perfect time to obtain financing and there are no interest-free loans. Whatever the current rate happens to be when you need equipment financing, it shouldn’t stop you from growing your business or scaling at the right time.

Lack of Borrowing History

Every lender looks at both a business’ borrowing history and personal credit history of the owner. A strong business borrowing background helps justify credit decisions and allows more credit to be extended to the borrower. However, many business owners may be unfamiliar with how to manage their business credit score.

To build your business’ borrowing history, borrow from a business lender and keep company assets under the business name. Do this even when you have the cash on hand to pay outright or could potentially get a better rate on a personal loan for certain pieces of equipment.

The process of establishing a business borrowing history is similar to building a personal credit history. While you may not qualify for the best terms on your first loan, you’re working towards qualifying for better terms in the future. If you never start, you’ll never be able to secure better terms in the future. So, the sooner you start building a borrowing history for your business, the better.

Lack of Time in Business

Start-up operations and newer businesses have a difficult time securing funding due to a lack of business borrowing history and a higher risk of failure. However, some business lenders, such as Blue Bridge Financial, are willing to lend to new businesses in certain industries. This is when personal credit becomes extremely important. It’s one of the primary factors in determining an approval for start-ups or newer businesses.

When applying for funding as a new business, keep in mind that it’s harder to secure a large amount. Many lenders cap financing for new businesses at around $100K. A down payment is also required to ensure the owner is permanently invested in the business.

A solid business plan is also important for new businesses and start-ups seeking financing. Lenders may ask for more information or request additional questionnaires to learn why you’re confident in your business idea and what experience you have to make you successful.

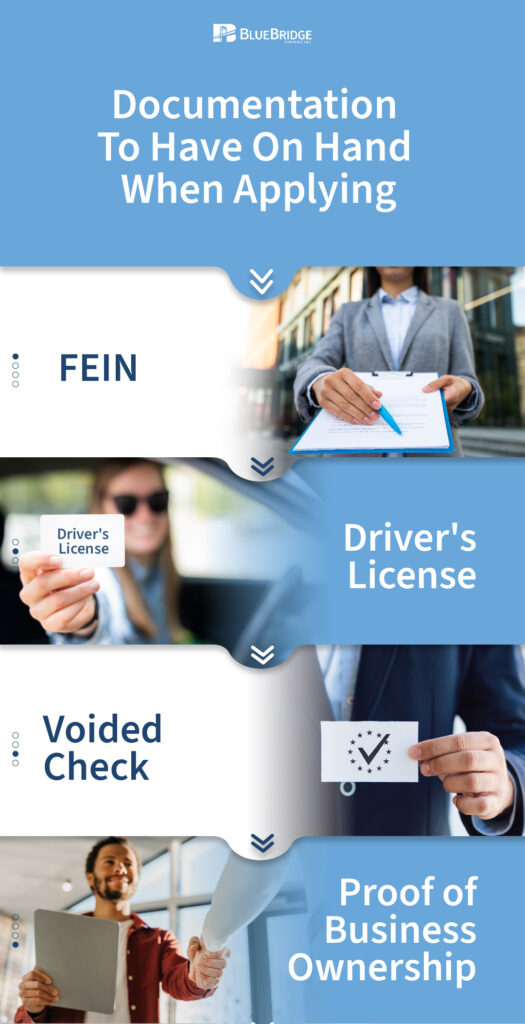

Ready With Required Documentation

To have a smooth and efficient funding process, be prepared with your documentation before you fill out the application. This includes, but isn’t limited to:

- FEIN number

- Scan/picture of your Driver’s License

- Voided check from the bank account we will take payment from

- Proof of business ownership, which can be found on a schedule K-1 tax form or the company’s articles of incorporation.

Having these items ready to go with your application will keep the process moving as quickly as possible. If you wait to submit your documentation, this will push back your approval and delay your funding.

Finding a Legitimate Equipment Seller

Although there are benefits to working with private parties for your equipment purchase, the funding process is smoothest when you work with an established dealership. This is because dealerships are willing to communicate directly with funding teams instead of using you as an intermediary. They are also motivated to complete the transaction as quickly as possible, whereas a private party seller may not be in a hurry. Private parties may also have to provide additional documentation or pay off equipment before selling it, delaying the process.

About Blue Bridge Financial

Founded in 2009, Blue Bridge Financial is a specialty equipment finance firm providing small and medium-sized businesses with secured loans for revenue-producing, essential-use equipment. We work with businesses in 30+ industries and we can fund your business, too. To learn more about the funding process, check out our FAQs page or contact us to learn more about our flexible loan programs, including Equipment Finance Agreements, and competitive rates. There are no age or mileage restrictions and we work with private party sellers.

Any Questions? We'd Love to Talk:

About the Author

Nick Devernis is the Vice President of Business Development with expertise in credit analysis and equipment financing. With over 6 years in equipment financing, he offers a wealth of knowledge to readers of Blue Bridge Financial’s blog. He currently oversees the California office and leads the Sales and Marketing departments. Nick’s role as Vice President of Business Development involves management of the sales team, relationship management, and developing strategic partnerships to drive inbound and outbound originations.p> LinkedIn Profile