Challenges of Fleet Management

Tackle Fleet Management Head-On: Overcome the Biggest Challenges with Smart Solutions

Fleet managers have been hit hard in the last year due to a variety of factors such as lower freight rates and higher gas prices. As your experienced equipment lender, we understand the challenges faced by the transportation and service industries. In this article, we’ll cover the latest challenges to hit fleet management and how to navigate them.

Fleet Supply Chain Shortages

In 2023, the transportation industry experienced commercial vehicle shortages that will likely continue into 2024. This means that fleet managers may have to settle for a different OEM or a second-choice vehicle. Additionally, the UAW strike disrupted assembly lines. We hope to see supply chain issues improve as we get further from the pandemic-era disruptions.

Fleet Vehicle Maintenance

The limited number of replacement vehicles due to supply chain issues means that the average age of fleet vehicles is increasing. This puts fleet owners at more risk of unscheduled maintenance. And, if your vehicles go out of service unexpectedly due to lack of maintenance, you can lose money in downtime and delayed loads.

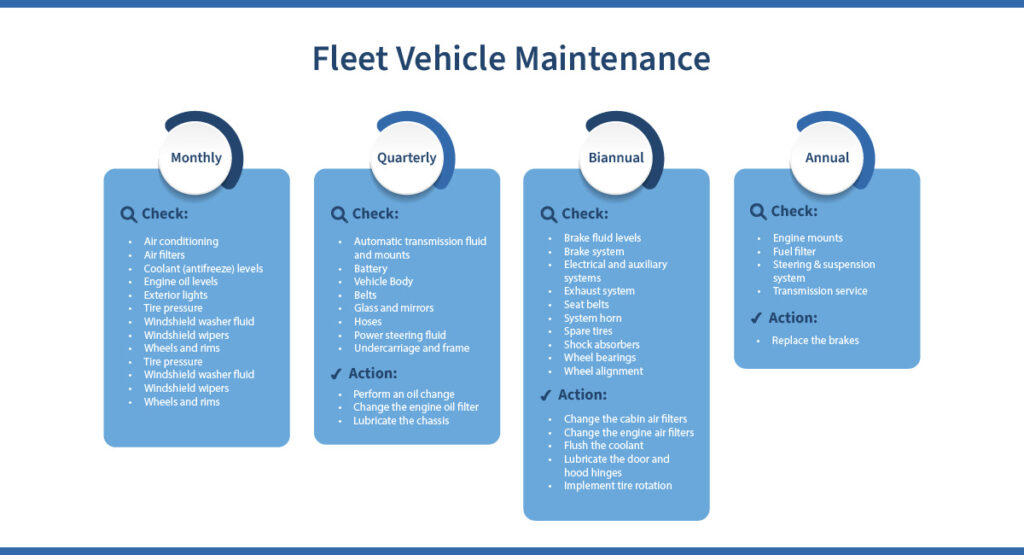

While you can’t control every outcome, keeping up on your fleet maintenance can save you headaches down the road. If you don’t already have a preventative maintenance program in place, we recommend creating one. This consists of things such as regular oil changes, keeping tire pressure at the proper level, getting tires rotated, and more. You can follow the service schedule provided by the vehicle’s manufacturer, as well as GPS fleet tracking software that will alert you when repairs and maintenance are needed.

EV Fleet Evolution

Commercial electric vehicle fleets are beginning to rise in popularity among fleet managers. With increased demand comes EV fleet charging services and turnkey solutions. If you’re planning to add EVs to your commercial fleet, you need to plan for charging needs, energy usage, and find vehicles that fit into both your budget and service requirements.

Fleet Fuel Prices

Fleet vehicles, such as semi-trucks, moving vans, and box trucks, require more fuel than your standard personal vehicle to operate. With gas prices on the rise, fleet managers need to learn how to work with and around the rising costs. You can use automation and software to track the performance and fuel efficiency of your fleet. Upgrading your moving vans and trucks to fight obsolescence will help with fuel efficiency as well.

Fleet Management Financing Options

Lenders may view fleet financing as a higher risk, particularly within the transportation industry. It’s important to understand your financing options before you seek financing. Here’s two options to consider:

- Equipment Finance Agreement (EFA): The equipment (such as a commercial vehicle) provides the collateral for the EFA. Your lender takes a security interest in it until the agreement is fully paid. One of the main benefits of an EFA is that you can finance 100% of the sales cost, reducing your expenses upfront and securing a monthly payment that works within your budget.

- Working Capital: With a simple application process and same-day funding, you can access the working capital you need to cover unexpected maintenance and operational expenses.

Fleet management can come with significant investment expenses. Partner with a lender like Blue Bridge who is willing to be flexible on terms and monthly payments for your moving vans, box trucks, and other commercial vehicles.

About Blue Bridge Financial

Founded in 2009, Blue Bridge Financial is a specialty equipment finance firm providing small and medium-sized businesses with secured loans for revenue-producing, essential-use equipment. Ready to add new or used vehicles to your fleet? We are your transportation and commercial fleet financing expert, having funded over 9,000 businesses in 30+ industries. We can fund your business, too! Contact us to learn more about our flexible loan programs and competitive rates tailored to your needs. There are no age or mileage restrictions and we work with private party sellers.

Any Questions? We'd Love to Talk:

About the Author

Nick Devernis is the Vice President of Business Development with expertise in credit analysis and equipment financing. With over 6 years in equipment financing, he offers a wealth of knowledge to readers of Blue Bridge Financial’s blog. He currently oversees the California office and leads the Sales and Marketing departments. Nick’s role as Vice President of Business Development involves management of the sales team, relationship management, and developing strategic partnerships to drive inbound and outbound originations.p> LinkedIn Profile