What You Need to Know About Factor Rates for Working Capital

Factor Rates 101: Decode the Real Cost of Working Capital Loans

Are you looking for working capital for your business? You may be confused by unfamiliar terms like factor rate and APR. They both play pivotal roles in determining the total cost of borrowing, but they can also serve different purposes. In order to choose the best type of financing for your business, it’s important to understand factor rate and APR and how they work. In this article, we’ll explain what factor rates are, how they differ from APR, how lenders determine factor rates, and how factor rates can benefit small businesses looking for short-term financing.

What Is a Factor Rate?

A factor rate is a fixed multiplier used by lenders to calculate the total repayment amount for a loan. Unlike an interest rate, which is applied to a remaining balance, the factor rate is applied to the original financing amount.

Factor rates are often used for working capital loans, merchant cash advances, and other short-term financing solutions. Instead of compounding over time, the factor rate remains consistent, which provides transparency in understanding the total cost of borrowing upfront.

For example, if you borrow $100,000 at a factor rate of 1.2, you’ll repay $120,000 regardless of how long it takes to pay off the loan. This predictability can be helpful for small businesses.

The factor rate ultimately determines the total cost of working capital, factoring in how much a business will pay over the financing term. It’s crucial to understand this multiplier because it directly affects the amount you’ll need to repay.

Understanding Factor Rates and APR: Differences

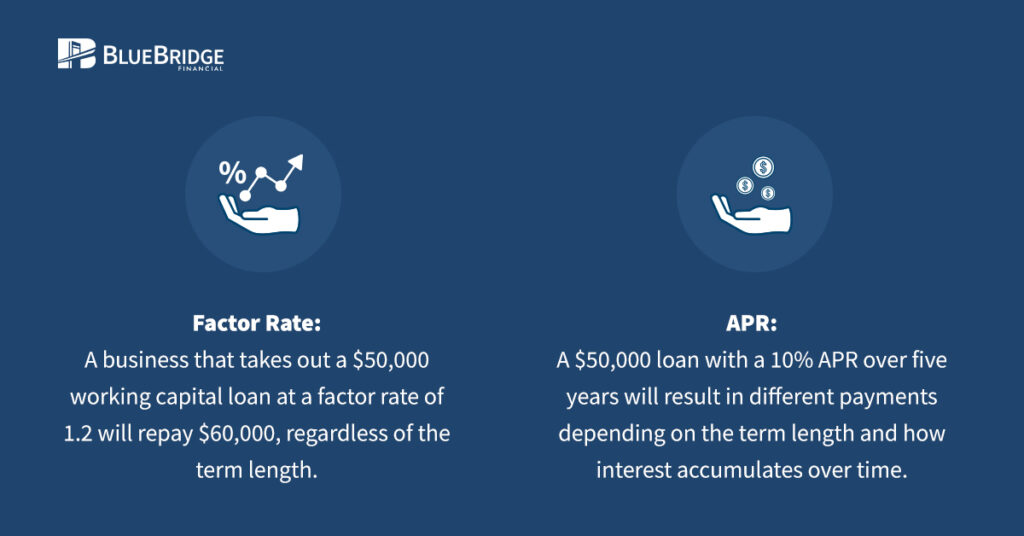

While both factor rates and Annual Percentage Rates (APR) measure the cost of borrowing, they are used differently.

Factor rates are typically used in short-term financing options, such as working capital loans or merchant cash advances. These loans are often used when a business needs quick access to cash for immediate operational costs like purchasing inventory, covering payroll, or managing other short-term expenses. Factor rates do not fluctuate based on the length of the loan term, and they remain fixed from the moment the loan is taken.

On the other hand, APR is more commonly applied to long-term financing, such as traditional business loans or equipment finance agreements (EFAs). APR encompasses all fees associated with the loan, including interest rates, closing costs, etc. It provides a complete picture of the annual cost of borrowing. The longer the loan, the more important APR becomes as it takes into account the time value of money and interest accumulation.

Understanding when to choose factor rates versus APR is critical. Short-term financing solutions like working capital loans may favor factor rates because of their simplicity, while longer-term loans will typically be structured using APR.

How Lenders Determine Factor Rates

Lenders take different things into consideraton when determining the factor rate for a loan. Understanding these components can help you gauge how much your business might pay for borrowing.

Business Risk Assessment

This is the primary element that influences factor rates. Lenders evaluate the business’s financial health by reviewing credit history, bank statements, and overall cash flow. A stable business with consistent revenue is likely to receive a lower factor rate than a business that poses more risk to the lender.

- Bank Statements: Lenders typically request recent bank statements to assess the business’s cash flow and revenue. Consistent revenue is crucial to receiving favorable terms.

- Time in Business: Businesses that have been operating for more than a year are usually more likely to receive lower factor rates.

- Credit History: Poor credit or a history of late payments will likely result in a higher factor rate.

Loan Amount and Term

The size of the loan and the repayment term also affect the factor rate. Larger loans or longer terms may result in higher factor rates due to the increased risk of default over time.

Market Conditions

Economic considerations, such as the current interest rate environment and lender competition, play a role in determining factor rates. When market conditions are favorable, businesses may secure lower factor rates due to increased competition among lenders.

Lenders use these considerations to set rates that reflect the overall risk and potential reward of providing capital to a business.

How Factor Rates Can Help Small Businesses Acquire Working Capital

Factor rates on working capital loans offer an attractive financing option for small businesses in need of funds. Since these rates are fixed and easy to understand, business owners can quickly determine their total repayment amount, allowing for better budgeting and financial planning. Factor rates are especially beneficial for short-term financing needs like working capital.

Here’s how factor rates can benefit businesses in different industries:

Construction Industry

Construction businesses often need short-term working capital financing to cover expenses like equipment rental, labor, and materials. Factor rates provide quick access to working capital, which can smooth out cash flow gaps during various project phases.

Manufacturing Industry

Manufacturers often need financing to purchase bulk inventory or raw materials. Factor rate loans offer flexible funding to help businesses manage their seasonal production cycles and maintain continuous operations.

Transportation and Logistics

Companies in this sector often need to cover operating expenses like fuel, maintenance, and staffing. Factor rates can provide the working capital required to scale operations and meet increasing demand, especially during peak seasons.

Healthcare Services:

Healthcare providers frequently face delays in receiving payments from insurance companies or clients. A factor rate loan can offer quick funding to ensure smooth day-to-day operations, or to cover expansion projects such as building new facilities.

Agricultural Industry

Farmers and agricultural businesses typically face seasonal fluctuations. Factor rate loans can help cover expenses during planting and harvesting seasons or provide funding for expanding and upgrading farmland.

By offering short-term, fast-access capital, factor rates help businesses across various industries remain agile and responsive to financial needs.

Tools and Tips for Small Business Owners: Making Informed Financing Decisions

When considering factor rate loans, it’s essential to make informed decisions. Here are some tools and tips for small business owners:

- Use Online Calculators: They can help you estimate loan costs and visualize the total cost of borrowing with a factor rate.

- Read the Fine Print: While factor rates can be straightforward, it’s crucial to read the loan agreement. Ensure you understand any additional fees or penalties that may apply.

- Consult Financial Advisors: It’s always a good idea to consult with a financial advisor or accountant when making significant financial decisions. They can help you decide whether a factor rate loan aligns with your business’s financial health and long-term goals.

- Consider Repayment Flexibility: Not all factor rate loans have flexible repayment terms. Some lenders require daily or weekly payments, which can strain cash flow if not properly managed. Ensure you choose a lender that offers terms suited to your business’s cash flow cycle.

About Blue Bridge Financial

Blue Bridge Financial is a specialty equipment finance firm serving many different industries. If you need short-term financing to cover everyday business expenses, check out our working capital loan. Looking to finance a new equipment purchase with a manageable monthly payment? Check out our Equipment Financing Agreement (EFA). Start our easy application today or contact us with questions. You can also read more about “Equipment Financing Basics,” “What to Look For In A Business Lender,” and “Common Financing Roadblocks.”

Frequently Asked Questions About Factor Rates

Factor rates are used to calculate the total repayment amount for working capital but differ from traditional interest rates as they don’t compound over time.

The total repayment is determined by multiplying the amount financed by the factor rate.

Factor rates offer a simple, upfront way for lenders to set repayment terms, especially for short-term loans.

Businesses needing quick capital for short-term needs, like inventory or operational costs, often benefit from factor rates.

Since factor rate repayments are fixed, businesses can predict cash flow impacts, though these payments are generally higher than those for interest-based loans.

Any Questions? We'd Love to Talk:

About the Author

Nick Devernis is the Vice President of Business Development with expertise in credit analysis and equipment financing. With over 6 years in equipment financing, he offers a wealth of knowledge to readers of Blue Bridge Financial’s blog. He currently oversees the California office and leads the Sales and Marketing departments. Nick’s role as Vice President of Business Development involves management of the sales team, relationship management, and developing strategic partnerships to drive inbound and outbound originations.p> LinkedIn Profile