What to Look For In A Business Lender

The Right Lender Can Make All the Difference—Here’s How to Find One

As a business owner seeking financing, you have plenty of options. However, not all lenders offer the same level of personalized and streamlined service. It’s important to choose the right lender to get essential funding needed to grow and upgrade your business. Ideally, you’ll find a lender you can trust and create a long-term business relationship with. In this article, we’ll cover everything you should consider when choosing a lender for your business financing needs.

What are their requirements?

The first thing you want to understand about a prospective lender is their requirements for approving financing applications. For example:

How many requirements do they look for in an application?

Is this going to be a relatively easy process, such as Blue Bridge’s one-page application that can be completed online? Or will it be a longer, more drawn-out process involving trips to an in-person location and multiple requests for documentation?

What are their credit score considerations?

What is the FICO score range they are willing to accept? Will they look at your personal credit score as well as your business history? At Blue Bridge, our FICO score minimum is 610 (700 for start-ups) and at least two years in business is preferred.

What are they looking for with business revenue and health?

Securing financing for your business typically requires strong business revenue, financial health, and overall viability. An ideal customer has established operations and extensive borrowing history.

Are there any collateral requirements?

It is important to look for a lender’s age or mileage restrictions when searching for financing, especially if the collateral you are looking to finance isn’t new. For example, with Blue Bridge’s equipment financing program, there are no age or mileage restrictions and your business equipment serves as collateral.

Generally, the more requirements a lender has, the harder it will be to meet their expectations and get approved. For example, traditional banks will typically have stricter restrictions. Alternative lenders like Blue Bridge are more flexible and faster with their approvals. Working with a specialty finance firm like Blue Bridge will allow you to acquire the equipment you need quicker!

How quick is their application?

As a business owner, we understand you are busy and don’t want to spend any more time than you have to on the application process. When evaluating a prospective lender, consider the following:

- Does their business loan application span pages upon pages, and require multiple steps?

- How much information do I need to fill out before I can submit my application and begin the financing process?

- Can I apply online, or do I have to go to a location?

- How quick is the pre-approval process?

- What does the timeline for final approval look like?

At Blue Bridge Financial, we try to make the application process as fast and easy as possible. Our one-page equipment financing application can be completed online, with funding in as little as 1-2 days.

What is the application process like?

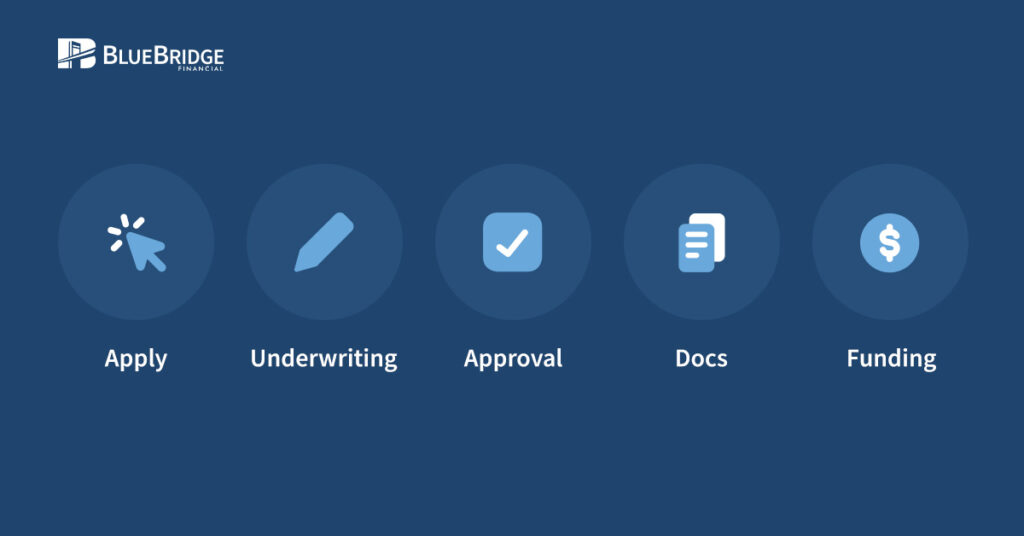

The actual application submission process should be simple and clear, but what happens during underwriting? Will your lender keep you informed with updates and feedback throughout the process? Ultimately, you want an application process that ends with a clear and straightforward closing and prompt funding.

At Blue Bridge Financial, our application process is simple and straightforward:

Apply > Underwriting > Approval > Docs > Funding

At Blue Bridge Financial, once we receive your application, our credit team will review your information and provide you with a decision typically within 4 business hours. If your application is approved, one of our sales representatives will guide you through your payment terms over the phone. At this stage, if additional documents are required, a sales representative will collect those from you as well. From that point, our funding team will reach out directly to you to finalize the documents and schedule the funding. If everything is provided to us promptly, we are able to fund as soon as the next day.

“We pride ourselves on speed and simplicity in our processes. For years equipment finance lenders have lagged behind comparable industries such as auto, mortgage, and personal lending due to a lack of technological innovation and fresh perspective. Our goal at Blue Bridge is to create a customer journey that matches and improves upon those processes. This commitment to efficiency is what will enable us to continue as one of the fastest growing independent lenders for years to come.” – Nick Dervenis, VP of Business Development

What is customer care like?

When it comes to business financing, you want to be able to talk to your lender when you have questions, in whatever medium is most convenient. Will you be able to easily reach a knowledgeable representative when you need to? Can they be helpful and efficient in solving issues and answering questions? Most importantly, does your lender actually understand your industry and therefore your specific business needs? For example, not a lot of lenders offer financing for used or private party equipment.

At Blue Bridge, we are available by email, phone, and the contact form on our website. So, you can reach us when you need to, in whatever way works best for you!

What is their reputation?

The Internet makes it easier than ever to assess a lender’s reputation and check for positive reviews on social media and Google. However, if all the reviews are 5-star, they be fake or disingenuous. On the other hand, a cluster of negative reviews could be indicative of one unhappy client review bombing a business and not necessarily a sign of a bigger problem.

Another factor to consider is how the lender responds to negative reviews. Do they seem to be trying to resolve misunderstandings and any other issues? For example, we have dealt with bad reviews and misunderstandings just like any other business, but we always try to respond and resolve the issue as best we can.

How long has the lender been in business? Do they seem reliable? What about industry accolades? You can also look for memberships to industry groups. For example, Blue Bridge is a member of the Equipment Leasing and Finance Association (ELFA), National Equipment Finance Association (NEFA), American Association of Commercial Finance Brokers (AACFB), Associated Equipment Distributors (AED), and Independent Equipment Dealers Association (IEDA). We are also accredited with the Better Business Bureau (BBB).

Most lenders won’t check all of these boxes perfectly, but having at least one or two of these attributes is a good sign.

How transparent are they about lending practices?

Last but not least, transparency in financing terms and lending practices is an important attribute in a lender. Do they communicate clearly about fees, interest rates, and loan terms? Are they clear in contracts with terms and conditions? Of course, it’s also on you as a customer to make sure you read and understand the terms of your loan. Ask questions if you’re not sure, as a misunderstanding or lack of transparency could cost you money in the long run.

About Blue Bridge Financial

Blue Bridge Financial is a specialty equipment finance firm serving small and medium-sized businesses in a variety of industries. Our experience covers all aspects of deal structuring including sales, underwriting, due diligence, documentation, billing, collections, and compliance. Our Equipment Finance Agreements offer flexible and affordable financing for revenue-producing, essential-use equipment. Start our easy application today or contact us with questions about the process.

Any Questions? We'd Love to Talk:

About the Author

Nick Devernis is the Vice President of Business Development with expertise in credit analysis and equipment financing. With over 6 years in equipment financing, he offers a wealth of knowledge to readers of Blue Bridge Financial’s blog. He currently oversees the California office and leads the Sales and Marketing departments. Nick’s role as Vice President of Business Development involves management of the sales team, relationship management, and developing strategic partnerships to drive inbound and outbound originations.p> LinkedIn Profile