Understanding the True Cost of Equipment Ownership vs. Financing

See Beyond the Price Tag: What Equipment Really Costs You Over Time

When your business needs new equipment, it’s easy to focus on the sticker price. But a more important question is: What’s the true cost over time? And beyond that, what will this equipment allow your business to do? Will it drive revenue, open new markets, or boost efficiency?

Once you’ve determined that the equipment aligns with your business goals, the next big decision is how to pay for it. Should you make a lump-sum payment or explore financing options that help preserve your cash flow? While paying cash can make sense in some situations, nearly 8 out of 10 businesses choose to finance their equipment—so you’d be in good company if you decided to go that route.

So how do you decide which path is right for your business?

This article breaks down the complete picture, the financial, operational, and tax-related implications of ownership vs. financing, so you can make a confident, informed decision that supports your long-term goals.

Option #1: Outright Equipment Ownership

Paying cash up front might feel like the simplest option. You skip the loan process, avoid interest charges, and walk away with an asset that belongs to you. But for many businesses, that simplicity comes with some significant tradeoffs.

The Pros

- No monthly payments: Once you’ve paid for the equipment, it’s yours; you don’t owe anything further.

- No interest expense: You avoid finance charges.

- Immediate ownership: You gain full control and can use, modify, or resell the equipment at any time.

The Cons

- Large cash outlay: Tying up capital can strain cash flow, especially if the equipment is expensive.

- Opportunity cost: Money spent upfront could have been used for payroll, inventory, or growth opportunities.

- Depreciation risk: The value of equipment typically declines over time, and you carry that burden directly.

Even though you own the equipment, it may lose value faster than it adds revenue. And draining your cash reserves could limit your flexibility if unexpected costs arise.

That’s why many businesses turn to financing as a way to manage costs more strategically, without compromising their ability to invest in other areas of the business.

Option #2: Equipment Financing

Financing allows you to pay over time, often with manageable monthly payments and terms that align with your budget, revenue seasonality, and how you intend to use the equipment.

The Pros

- Preserve cash flow: Keep capital on hand for daily operations or reinvestment.

- Fixed payments: Enables easier budgeting with consistent monthly costs.

- Eventual Ownership: Most financing options lead to full equipment ownership.

- Tax benefits: Interest and depreciation may be deductible, and Section 179 (a tax code provision allowing businesses to deduct the full purchase price of qualifying equipment) may apply. Consult a tax advisor to explore other potential benefits.

The Cons

- Interest charges: You’ll pay more over time than with a cash purchase.

- Monthly commitment: Payments become a fixed part of your budget.

However, for many businesses, the benefits of financing outweigh the costs, especially when equipment is expected to generate revenue right away. For many, the ability to earn now and pay over time can be very desirable.

Choosing the right business lender is an important part of the process, too. Learn more about what to look for and how to decide on our blog.

What’s the True Cost of Each Option?

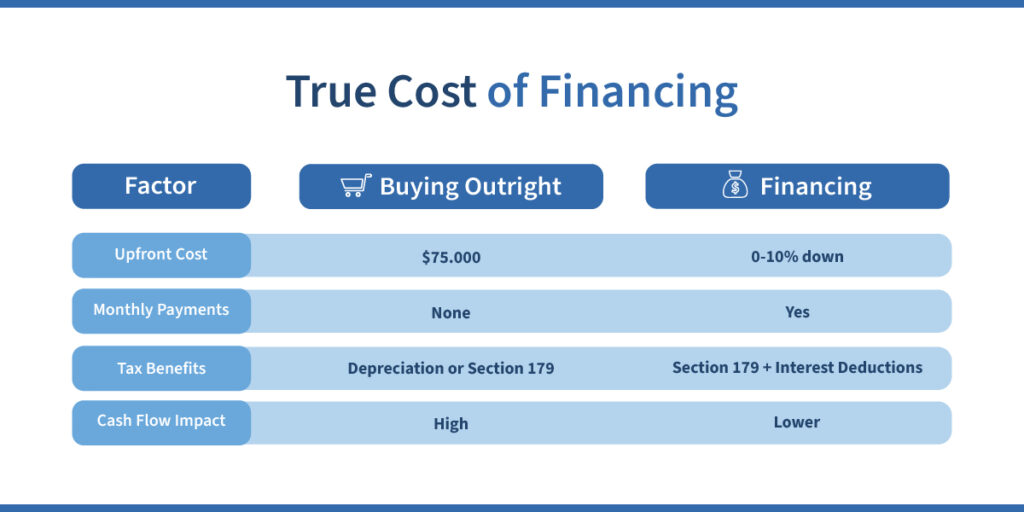

Let’s compare what buying versus financing might look like with a $75,000 piece of equipment. On the surface, both options provide access to the same tool, but the long-term financial impact can vary depending on how you pay.

Buying Outright:

- Cash outlay: $75,000 paid up front, which immediately impacts your cash reserves.

- Depreciation: You’ll typically deduct the cost over several years unless you qualify for Section 179, which allows for accelerated depreciation.

- No monthly payments: After purchase, there’s no recurring cost to budget for.

- No interest deduction: Since there’s no loan involved, you won’t benefit from any tax deductions related to financing charges.

While buying outright may seem like the simpler option, it often puts strain on working capital and may reduce your ability to respond to other financial needs that arise unexpectedly.

Financing:

- Down payment: Typically ranges from 0% to 10% depending on the lender and your business profile, keeping more cash available for operations.

- Monthly payments: Spread over 3 to 7 years, making it easier to budget and match the expense to the equipment’s use and income-generating potential.

- Section 179 deduction: You may be able to deduct the entire purchase price in the same year the equipment is placed into service—even if you’re only partway through the repayment period.

- Interest: Interest on the loan may be deductible as a business expense, further reducing your tax liability.

Financing can allow you to manage your cash more effectively while still gaining full use of the equipment. And thanks to the tax advantages of Section 179 and interest deductions, the total financial impact can be more favorable than it initially appears.

The Tax Angle: Why Financing Can Work in Your Favor

One of the biggest advantages of equipment financing is how it fits into your tax strategy.

With a qualifying loan or Equipment Financing Agreement, your business may be able to:

- Deduct the full purchase price under Section 179

- Use bonus depreciation to reduce taxable income further

- Deduct interest expense as part of your business costs

Read more about how Section 179 works and be certain to discuss the specifics of your business with a tax professional.

What About Maintenance and Upgrades?

Whether you buy or finance, you’re still responsible for upkeep. But financing often gives you room to afford newer, more efficient equipment tools that may reduce maintenance costs or boost output.

And because your cash isn’t tied up in the purchase, you may be better positioned to handle service, repairs, or replacements down the road.

What About Insurance?

Insurance plays a critical role in protecting your equipment investment and keeping your business running smoothly—whether you buy outright or finance. However, financing can actually support better insurance practices by requiring smart, protective measures from the start.

When you own the equipment outright, you’re responsible for securing your own coverage. While this gives you more flexibility in choosing your provider and setting coverage levels, it also means it’s up to you to ensure that policy choices fully protect your asset—something that’s easy to overlook when budgets are tight or time is short.

When you finance equipment, the lender typically requires insurance as part of the agreement. That may include minimum coverage levels and listing them as an additional insured or loss payee. While this might seem like added complexity, these requirements often work in your favor by ensuring your investment is properly protected from day one.

No matter how you acquire your equipment, these best practices can help safeguard your business:

- Ensure replacement value coverage—especially important with financing, as it often satisfies lender requirements and ensures full recovery if the equipment is lost or damaged.

- Review and update your policy as the equipment depreciates or your business needs change.

- Understand your deductibles so you’re prepared for potential out-of-pocket costs.

- Consider business interruption coverage to protect your income if the equipment is temporarily out of service.

In short, financing not only helps preserve your cash flow—it often helps enforce stronger risk management from the start.

Final Thoughts: Choosing the Right Path for Your Business

There’s really no one-size-fits-all answer to the question of which path is best. The right choice depends on your cash position, revenue expectations, and tax planning, among other factors.

In order to be best prepared, ask yourself:

- Can your business afford to pay cash without limiting operations?

- Will the equipment generate enough revenue to cover financing costs?

- Could your business benefit from Section 179 and other deductions?

Would spreading payments help protect your cash flow?

How Blue Bridge Financial Can Help

At Blue Bridge Financial, we help businesses finance equipment with confidence. Our Equipment Financing Agreements (EFAs) offer:

- Flexible terms

- Predictable monthly payments

- Fast approval

- Potential for Section 179 eligibility

Apply today to get started or contact us with your questions.

About Blue Bridge Financial

Blue Bridge Financial is a trusted equipment financing provider serving businesses across a wide range of industries. Whether you’re investing in new equipment or need a short-term working capital loan, our team makes the process simple, fast, and tailored to your needs. Get started with our easy online application or reach out today.

Frequently Asked Questions About Growing Your Construction Business

Paying cash avoids interest but may tie up capital you could use elsewhere. Financing allows you to spread out payments, preserve cash flow, and potentially claim valuable tax deductions.

Yes—if the equipment qualifies and is placed into service by year-end, you may be able to deduct the full purchase price even if you’re still making payments.

While interest is incurred, tax deductions and preserved cash flow may offset those costs, depending on financial goals and equipment use.

While renting or leasing may seem flexible, it often ends up costing more over time without building equity. Financing typically provides better long-term value, tax benefits, and ownership advantages. Learn more at bluebridgefinancial.com.

In most cases, yes. Blue Bridge Financial offers financing for both new and used equipment, depending on the type, age, and condition. Learn more in our guide to financing used equipment.

Start with a simple application at bluebridgefinancial.com or contact our team for help exploring your options.

Any Questions? We'd Love to Talk:

About the Author

Nick Devernis is the Vice President of Business Development with expertise in credit analysis and equipment financing. With over 6 years in equipment financing, he offers a wealth of knowledge to readers of Blue Bridge Financial’s blog. He currently oversees the California office and leads the Sales and Marketing departments. Nick’s role as Vice President of Business Development involves management of the sales team, relationship management, and developing strategic partnerships to drive inbound and outbound originations.p> LinkedIn Profile